INDUSTRY: INSURANCE AND SURVEYORS

DYNAMIC SCHEDULING AND ROUTE PLANNING SOFTWARE FOR INSURANCE AND SURVEYORS

Rapid response capability in emergencies

Products in the UK insurance industry include risk protection, adjustment, and financial security provision in all areas of private and public life. When a customer reports a claim to their insurance company, they need clarification about the insurance benefits in the individual case as quickly as possible.

This requires customer-oriented planning of the expert and valuer/adjuster deployment. However, this planning is also significantly tied to incalculable influencing factors. Natural disasters, for example a flood or fire, bring with them a sudden and enormous volume of claims (mass loss/damage events). Damage assessment must then be carried out within the shortest possible time and requires a high level of expert resources, in person.

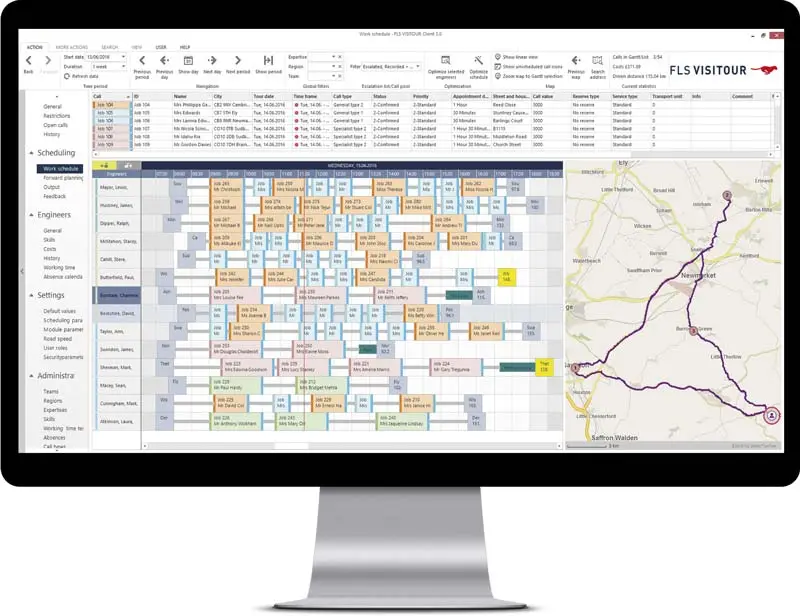

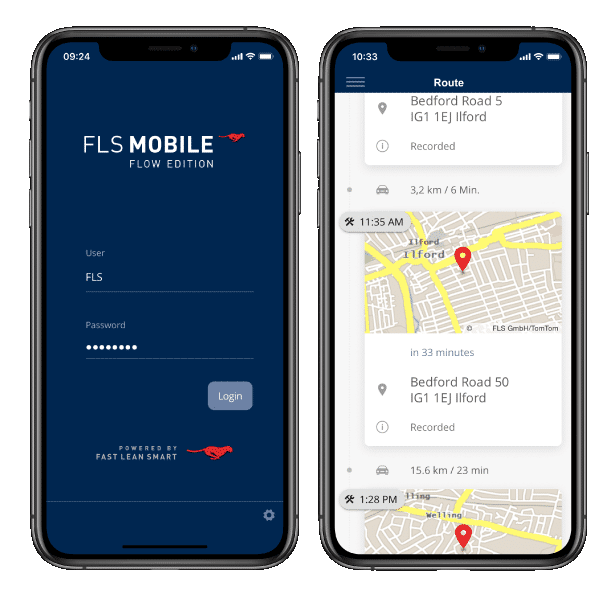

Thanks to the dynamic real-time planning with FLS VISITOUR, you can easily and efficiently schedule short-term appointments for surveyors, experts and consultants into existing tours. The use of the FLS MOBILE app also enables permanent communication between experts and office staff or dispatch, which means that the customer can be notified of the exact arrival time of the expert. Fierce competitive pressure due to the increasingly accessible opportunity to choose from a menu of insurance products (without even talking to a broker/representative) means a high quality digital journey is a critical loyalty-building factor.

PowerOpt calculates appointments and tours based on real-time data - and delivers precise results in seconds. This creates balanced opportunities: Agents can receive their instructions to their connected device. Cost transparency and live data therefore provides the opportunity for your operatives to begin their shifts from home addresses, saving unnecessary fuel use to a head office.

FLS REAL-TIME SOFTWARE FOR INSURANCE AGENTS

Trained professionals are an indispensable part of the insurance industry. The customer is entitled to detailed and professional advice with suitable, quick solutions.

With FLS VISITOUR, we have developed a solution for field service management (Field Service Management) that really meets these criteria. The key to this is the unique PowerOpt algorithm. More than 10 years of development and research work on the logistical problems of deployment and route planning have gone into PowerOpt.

Technology makes it possible for you to finally map the complex requirements of field service optimally. And in real time, even if changes occur during the course of the day.

FLS software solutions enable companies to fully exploit their potential to save costs and increase efficiency. This is because the planning processes, tours and routes can be significantly optimised thanks to the unique PowerOpt algorithm. With solutions from FLS, you get automated route planning and route optimisation that gets the most out of your order books.

Our software for your deployment and tour planning or your field service management plans the day in a matter of seconds. This gives your employees time for the essentials, such as escalation management.

You can plan in-person service calls fully automatically according to the different types of operation and take into account the relevant factors for each customer.

The system optimally assigns your technicians to jobs according to their skills and availability. This speeds up claims processing and increases the success rate. Real-time CRM integration ensures that all asset history needed for the claim is available.

Optimised planning makes your processes more efficient, reduces time lost and miles driven. You optimally deploy your service technicians and create a more productive processing of orders.

SUCCESS STORIES FROM OUR CUSTOMERS IN THE INSURANCE INDUSTRY

FLS CUSTOMERS IN THE INSURANCE AND SURVEYING SECTOR:

AND THERE'S MORE: MOBILE SUPPORT FOR YOUR FIELD AGENTS

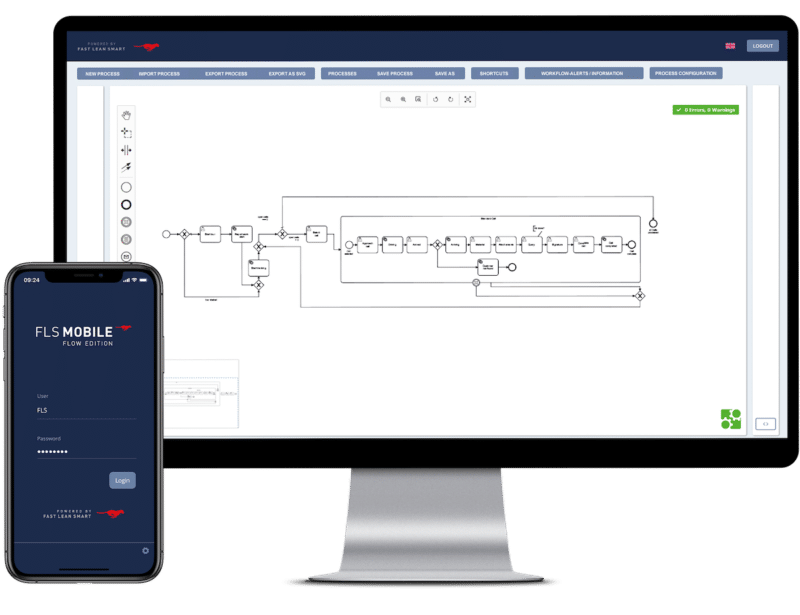

With clever Field Service Management solutions.You can use the software FLS VISITOUR for route and tour planning with the mobile app FLS MOBILE. In this way, the tours for in-person service are optimally planned. All steps - from the dispatch of agents to the execution of the claim on site - are regulated. On the go, the system then intuitively guides the employees through all points on their smartphone or tablet. This helps to avoid errors, ensures automated documentation and increases customer satisfaction.

With FLS MOBILE, your agents get exactly the information they need to deliver ideal service and increase customer satisfaction. Our mobile field service management application is tailored to field services and supports you every step of the way. Your agents can access service history and relevant forms at hand. They can create new work orders directly. Thanks to this mobile support, errors can be avoided and workflows are digital-first.

Part of high quality standards are careful documentation of all processes in order to be able to trace the claims actions in case of errors or further undiscovered damage. You must ensure that all proactive and reactive visits are tracked. FLS understands the importance of being able to comply with your regulations and processes and supports you with specially developed features such as quality metrics, photos, and sign-on-glass signatures.

FLS locations in Germany and Great Britain are certified according to ISO/IEC 27001, ISO 9001, ISO 14001, and in the UK we are part of the Financial Supplier Qualification System (FSQS) Community.

MEET THE OPTIMISATION POTENTIAL WITHIN YOUR ORGANISATION

FLS software optimises the Insurance industry. We'll show you how, just contact us using the form.

Alternatively email info@fastleansmart.com

or phone +44 1183 800189

Further reading:

Learn about FLS integration with your ERP:

SAP ERP and Microsoft Dynamics 365 ›

FLS Partners who can provide specialist advice on integration with their own technologies:

Find an FLS Partner ›